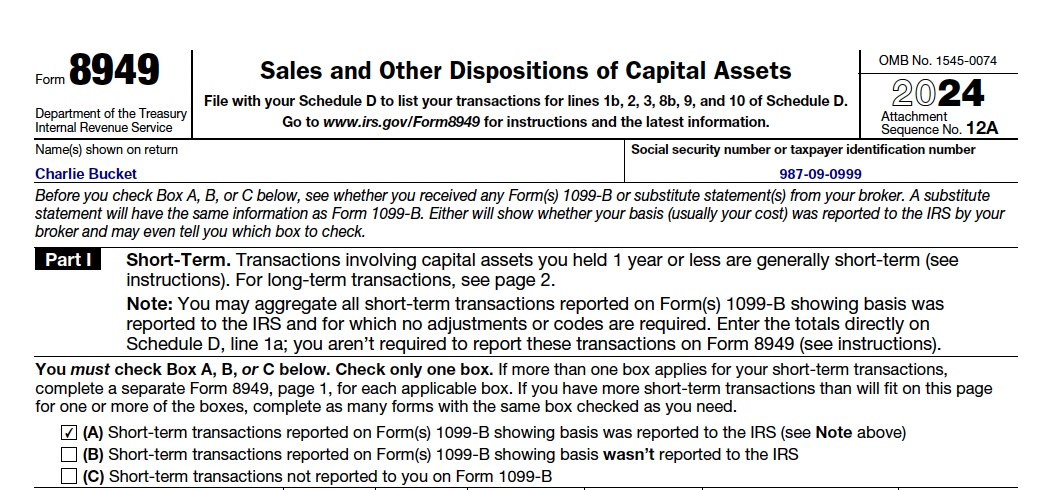

Understanding Form 8949 for Cryptocurrency Taxes

Learn how Form 8949 is used to report cryptocurrency capital gains and losses for tax purposes.

Read More →Learn more about cryptocurrency taxation, Form 8949, and how to properly report your crypto transactions.

Learn how Form 8949 is used to report cryptocurrency capital gains and losses for tax purposes.

Read More →

Learn how FIFO and HIFO cost basis methods work and which one could save you money on your crypto taxes.

Read More →

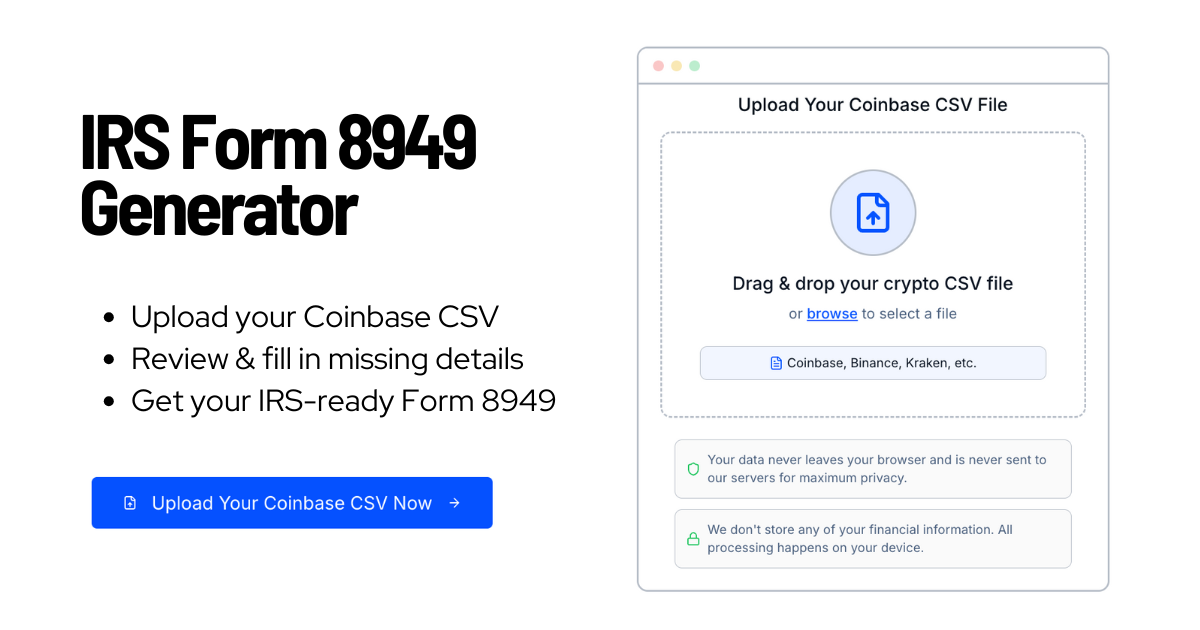

Step-by-step guide on how to export your cryptocurrency transaction history from Coinbase for tax reporting purposes.

Read More →

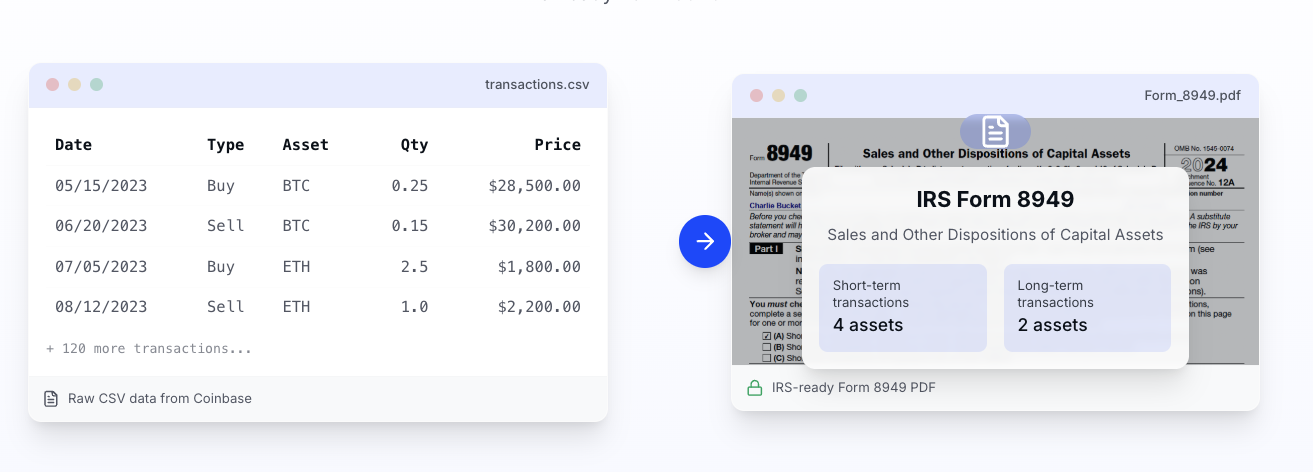

Tired of spreadsheets? Instantly convert your Coinbase CSV into a ready-to-file IRS Form 8949. Get your crypto taxes done quickly and accurately.

Read More →

A comprehensive guide to Form 8949, explaining what it is, who needs to file it, and how to complete it correctly.

Read More →

A comprehensive guide for Coinbase users on how to report cryptocurrency transactions on Form 8949, updated for 2025 tax rules.

Read More →

Learn how to properly fill out Form 8949 for your cryptocurrency transactions with our comprehensive step-by-step guide.

Read More →

Learn what IRS Form 8949 is, who needs to file it, and how to report capital gains from cryptocurrency, stocks, NFTs, and other investments.

Read More →