Tax Strategies

Form 8949 Team

May 25, 2023

3 min read

FIFO vs HIFO: Choosing the Right Calculation Method

When you sell cryptocurrency, the IRS wants to know your profit or loss. But if you bought Bitcoin at different prices over time, which purchase price do you use? That's where cost basis methods come in. The two most common approaches are FIFO (First In, First Out) and HIFO (Highest In, First Out), and choosing the right one can significantly impact your tax bill.

How FIFO Works

FIFO assumes you sell your oldest coins first. It's straightforward and matches how most people think about inventory.

Here's an example. Say you bought 1 Bitcoin in January 2023 for $20,000 and another Bitcoin in June 2023 for $30,000. Later, you sell 1 Bitcoin for $45,000. Under FIFO, you're selling that January coin first, so your cost basis is $20,000. Your taxable gain is $25,000.

FIFO is the default method the IRS assumes if you don't specify otherwise. It's simple to track and widely accepted, making it a safe choice for most taxpayers.

How HIFO Works

HIFO takes the opposite approach. Instead of selling your oldest coins, you sell the ones with the highest cost basis first. This reduces your taxable gain because you're subtracting a larger purchase price from your sale proceeds.

Using the same example, if you sell 1 Bitcoin for $45,000 and apply HIFO, you'd use the $30,000 June purchase as your cost basis. Your taxable gain drops to $15,000 — that's $10,000 less in reportable income compared to FIFO.

For investors who accumulated crypto at varying prices, HIFO can result in meaningful tax savings.

Which Method Should You Choose?

The best choice depends on your situation. FIFO works well if you bought most of your crypto at relatively low prices and want simplicity. It's also the safer option if you're unsure about record-keeping requirements.

HIFO makes sense if you've purchased crypto at different price points and want to minimize your current tax liability. It's particularly useful in volatile markets where you may have bought some coins near price peaks.

One important consideration is holding period. Under FIFO, your oldest coins are typically long-term holdings (owned over one year), which qualify for lower capital gains rates. HIFO might result in selling newer coins that are still short-term, potentially taxed at higher ordinary income rates. Run the numbers both ways to see which actually saves you more.

Staying Compliant

The IRS requires you to apply your chosen method consistently and maintain records that support your calculations. You'll need documentation showing when you acquired each coin and at what price. Switching methods year to year without proper justification can raise red flags.

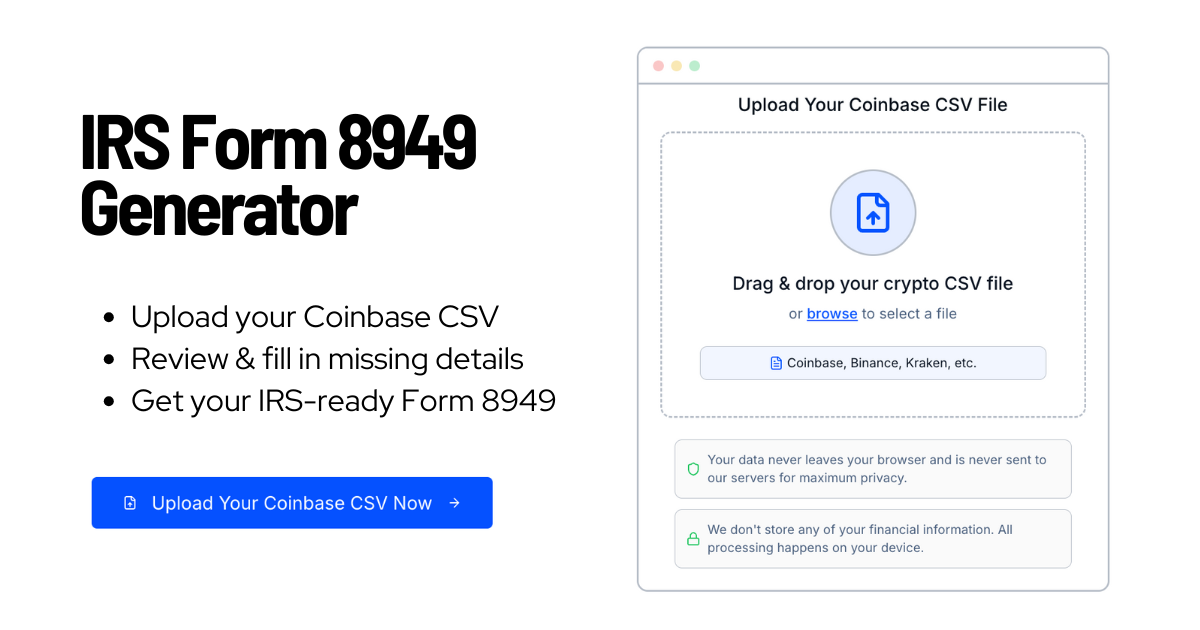

Our

Form 8949 generator supports both FIFO and HIFO calculations. Upload your Coinbase CSV, select your preferred method, and we'll handle the math while generating an IRS-ready PDF.

The Bottom Line

FIFO is simple and universally accepted. HIFO can reduce your tax bill but requires careful record-keeping. Both are legitimate methods — the key is choosing one, applying it consistently, and documenting your transactions properly.

Ready to calculate your gains?

Generate your Form 8949 using either method in about 60 seconds.