Form 8949 Instructions: How to Fill It Out for Crypto Taxes (Step-by-Step)

Filing taxes for cryptocurrency transactions can be confusing, especially when it comes to IRS Form 8949. This step-by-step guide breaks down exactly how to complete this critical tax form correctly for your crypto investments.

What Is IRS Form 8949?

Form 8949 (Sales and Other Dispositions of Capital Assets) is the tax form used to report capital gains and losses from investments, including cryptocurrency. The IRS classifies cryptocurrency as property, not currency, meaning every crypto transaction potentially triggers a taxable event that must be reported on Form 8949.

The form requires you to list each transaction individually, documenting the acquisition date, sale date, cost basis, proceeds, and resulting gain or loss. Think of it as a detailed transaction log that feeds into Schedule D of your tax return.

Who Needs to File Form 8949?

You need to file Form 8949 if you:

- Sold or exchanged cryptocurrency for fiat currency (like USD) - Traded one cryptocurrency for another cryptocurrency - Used cryptocurrency to purchase goods or services - Received cryptocurrency through mining or staking (and later sold it) - Received cryptocurrency as payment and later disposed of it

Even if you use a crypto exchange like Coinbase that provides a 1099 form, you still need to complete Form 8949 to properly report all your crypto transactions.

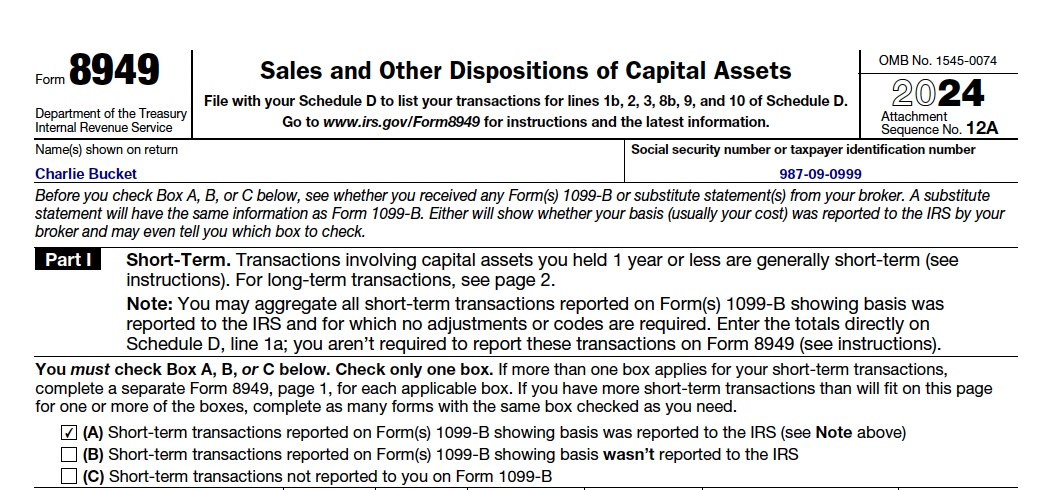

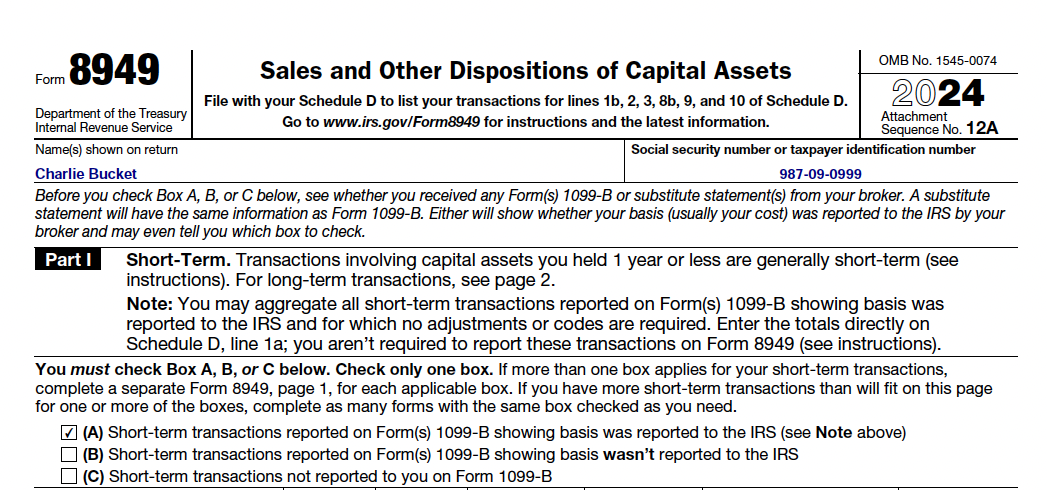

Form 8949 Instructions: Step-by-Step

Determine Short-Term vs. Long-Term

Form 8949 is divided into two parts:

- Part I: Short-term transactions - For crypto held for one year or less - Part II: Long-term transactions - For crypto held for more than one year

This distinction is crucial because short-term and long-term gains are taxed at different rates. Long-term gains typically qualify for lower tax rates than short-term gains, which are taxed at your ordinary income tax rate.

You'll need to organize your transactions into these two categories before filling out the form. If you have both types of transactions, you'll need to complete both sections.

Fill in the Columns

Form 8949 has columns (a) through (h) that must be completed for each crypto transaction:

- Column (a) Description of Property: Enter the name and amount of cryptocurrency sold (e.g., "1.5 BTC" or "500 ETH") - Column (b) Date Acquired: Enter the date you purchased or received the crypto (MM/DD/YYYY) - Column (c) Date Sold: Enter the date you sold, traded, or disposed of the crypto (MM/DD/YYYY) - Column (d) Proceeds: Enter the fair market value of what you received (in USD) - Column (e) Cost Basis: Enter your original investment amount plus fees (in USD) - Column (f) Code: Enter the applicable adjustment code, if any (rarely used for most crypto transactions) - Column (g) Adjustment: Enter any adjustment amount (usually left blank for most crypto transactions) - Column (h) Gain or Loss: Calculate the difference between proceeds (d) and cost (e), adjusted by any amount in column (g)

For cryptocurrency specifically, determining the correct cost basis can be challenging, especially if you've made multiple purchases at different prices. The IRS allows several accounting methods, with FIFO (First In, First Out) being the most common.

Add Totals to Schedule D

After completing Form 8949, you'll need to:

1. Total the amounts in columns (d), (e), (g), and (h) 2. Transfer these totals to the corresponding lines on Schedule D 3. Complete Schedule D to calculate your total capital gain or loss

Schedule D combines all your capital transactions (including crypto) to determine your net capital gain or loss for the tax year.

Smart Tip: Use a Form 8949 Generator

Manually tracking hundreds of crypto transactions and filling out Form 8949 can be extremely time-consuming and error-prone. This is where specialized tools can help.

If you're a Coinbase user, you can easily generate your Form 8949 using our automated tool. Simply upload your Coinbase CSV transaction history, and we'll organize all your transactions, calculate your gains/losses, and create an IRS-ready Form 8949 — all within minutes.

The tool automatically: - Separates short-term and long-term transactions - Calculates cost basis and proceeds for each transaction - Determines your gain or loss on each trade - Generates a perfectly formatted Form 8949 you can submit to the IRS

Instead of spending hours manually entering data, you can get your IRS-ready Form 8949 instantly for just $5.

Common Questions About Form 8949 Instructions

Do I need to report crypto-to-crypto trades on Form 8949? Yes, the IRS considers exchanging one cryptocurrency for another a taxable event. You must report the fair market value (in USD) of the cryptocurrency received at the time of the trade.

What if I don't have all the information required for Form 8949? You must make a good-faith effort to obtain all required information. For missing acquisition dates, some taxpayers use the earliest possible date and indicate that the information is missing despite reasonable efforts to obtain it.

Can I aggregate similar transactions on Form 8949? In some cases, you can consolidate similar transactions. However, for cryptocurrency, it's generally best to list each transaction separately to ensure accuracy and avoid IRS scrutiny.

What if I have more transactions than fit on one Form 8949? Use as many copies of Form 8949 as needed. Complete the totals on only the last page for each part.

How do I report mining or staking rewards on Form 8949? Mining and staking rewards are typically reported as income when received. When you later sell these coins, you report that sale on Form 8949 with your cost basis being the value reported as income.

Final Thoughts

Properly completing Form 8949 for cryptocurrency transactions is essential for tax compliance. While the form may seem complicated, breaking it down step by step makes the process manageable.

For Coinbase users looking to simplify the process, our Form 8949 generator reduces hours of manual work to just a few clicks. Upload your Coinbase CSV and generate your IRS Form 8949 in minutes—only $5 at Form8949.org.

Remember, while this guide provides general instructions, tax situations vary. Consider consulting with a tax professional for personalized advice on your specific situation.

Staying compliant with crypto taxes doesn't have to be difficult. With the right tools and knowledge, you can confidently report your cryptocurrency transactions and avoid potential penalties from the IRS.

If you found this guide helpful, check out our related articles on how to file Coinbase taxes and what is Form 8949 for more in-depth information.