If you've sold cryptocurrency, stocks, or any investment this year, you've probably heard about Form 8949. But what exactly is it, and do you actually need to file one?

This guide breaks down everything you need to know about IRS Form 8949 — what it is, who needs it, what assets it covers, and how to fill it out without the headache.

What Is IRS Form 8949?

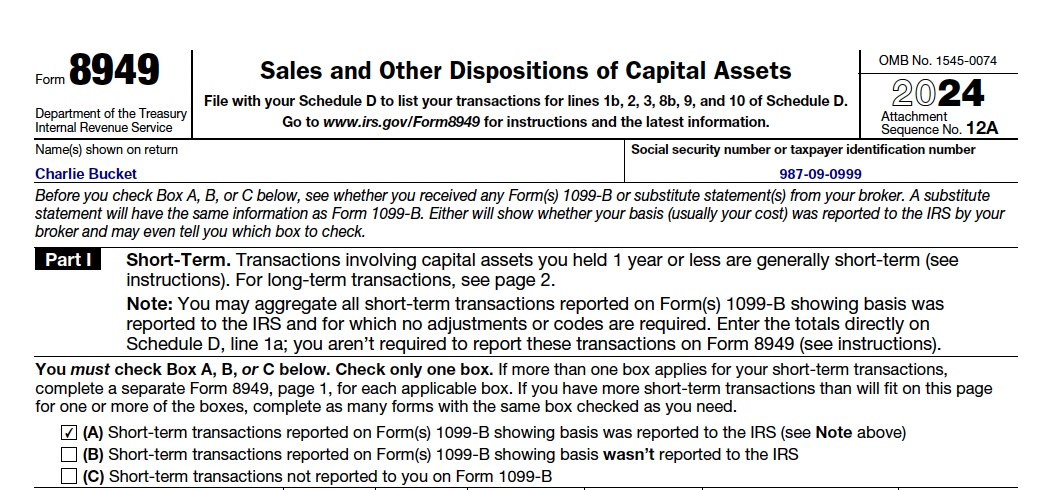

IRS Form 8949, officially titled "Sales and Other Dispositions of Capital Assets," is the tax form used to report when you sell investments for a profit or loss.

Think of it as a detailed transaction log. Every time you sell stock, trade cryptocurrency, cash out an NFT, or dispose of any capital asset, you need to record that transaction on Form 8949.

The form captures the essential details for each sale: what you sold (description of the asset), when you bought it (date acquired), when you sold it (date sold), how much you received (proceeds), what you paid (cost basis), and your gain or loss (the difference).

The totals from Form 8949 then flow to Schedule D of your Form 1040, which calculates your overall capital gains tax.

Who Needs Form 8949?

You need to file Form 8949 if you disposed of any capital asset during the tax year. This includes cryptocurrency traders, stock investors, NFT collectors, and real estate investors.

Cryptocurrency Traders

The IRS treats crypto as property, not currency. That means every sale, trade, or exchange triggers a taxable event. Sold Bitcoin for cash? Traded ETH for SOL? Used crypto to buy a coffee? All reportable on Form 8949.

Stock Investors

Sold shares through Robinhood, Fidelity, or any brokerage? Those transactions go on Form 8949. Your broker sends you a 1099-B with the details, but you still need to report them on the form.

NFT Collectors

NFTs are treated like any other property — when you sell, you report the gain or loss on Form 8949.

Real Estate Investors

Sold an investment property (not your primary residence)? That sale gets reported on Form 8949 too.

The bottom line is simple: if you sold it and it's not your personal home or car, it probably goes on Form 8949.

What Assets Does Form 8949 Cover?

Form 8949 covers the sale or disposition of virtually any capital asset. This includes cryptocurrency like Bitcoin, Ethereum, and Solana. It also covers stocks and ETFs, bonds, mutual funds, NFTs, options and futures, investment real estate, and collectibles like art and precious metals.

The only major exceptions are your personal residence (which has its own rules) and retirement accounts like 401(k)s and IRAs (which are tax-deferred).

Short-Term vs. Long-Term Capital Gains

Form 8949 is split into two parts, and the distinction matters for your tax bill.

Part I covers short-term transactions — assets held for one year or less. These are taxed at your ordinary income rate, which can be as high as 37%.

Part II covers long-term transactions — assets held for more than one year. These qualify for preferential tax rates of 0%, 15%, or 20% depending on your income.

This distinction can save you thousands in taxes. If you're sitting on crypto gains, consider holding past the one-year mark before selling to qualify for the lower long-term rate.

Form 8949 vs. Schedule D

People often confuse these two forms. Form 8949 is the detailed list of every transaction. Schedule D is the summary that calculates your total gain or loss.

You complete Form 8949 first, listing each sale. Then you transfer the totals to Schedule D, which determines how much capital gains tax you owe. Both forms are attached to your Form 1040 tax return.

How to Fill Out Form 8949

Manually filling out Form 8949 is tedious, especially if you have dozens or hundreds of crypto transactions. Each trade requires looking up the date you bought, finding the original purchase price, calculating the cost basis, determining if it's short-term or long-term, and entering it all correctly in IRS format.

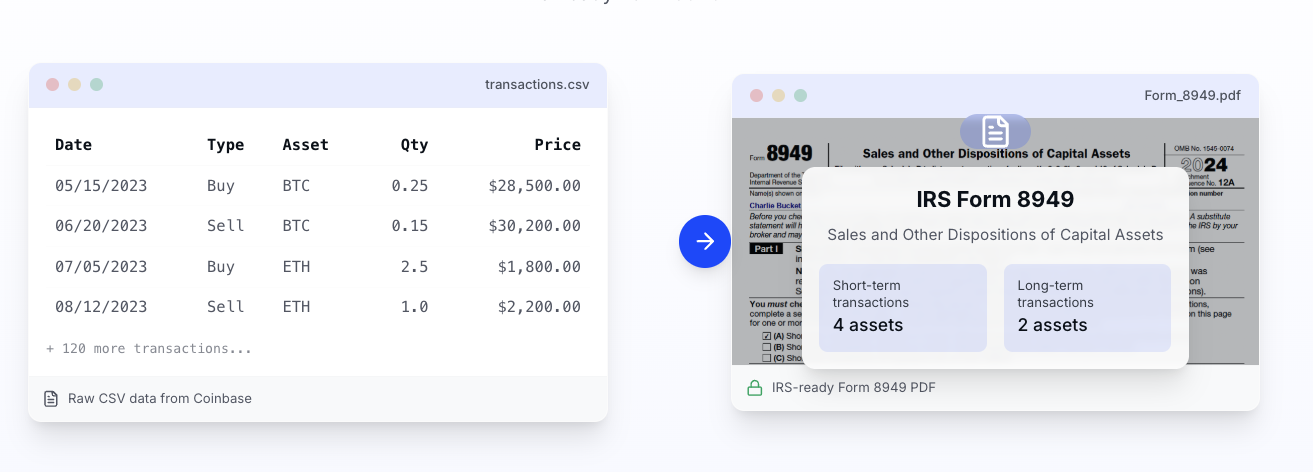

Our

free Form 8949 generator does the work for you. Just upload your Coinbase CSV, and we'll calculate cost basis automatically using HIFO for lower taxes. Then download your IRS-ready Form 8949 PDF.

It's secure (your data never leaves your browser) and takes about 60 seconds.

What Happens If You Don't File?

Ignoring your crypto or stock sales is risky. The IRS already knows about most transactions because brokers send 1099-B forms, and crypto exchanges are increasingly reporting to the IRS.

Failure to report can result in accuracy penalties (20% of the underpaid tax) plus interest. The IRS has made crypto a priority, and unreported gains are a red flag for audits.

Even if you had losses, you should report them. You can deduct up to $3,000 per year against ordinary income and carry forward excess losses to future years.

Summary

Form 8949 reports sales of capital assets like crypto, stocks, and NFTs. You need it if you sold, traded, or disposed of investments this year. Short-term gains are taxed higher than long-term gains, and the totals flow to Schedule D, which calculates your tax.

Ready to file?

Generate your Form 8949 from Coinbase in about 60 seconds.